Safe-Haven

Gold has historically served as a safehaven during times of economic uncertainty and market volatility. It acts as a hedge against inflation and currency fluctuations, preserving wealth when other assets might be devalued.

Store of Value

Gold has a long-standing reputation as a store of value and has been recognized as a form of currency for centuries. Its inherent scarcity and limited supply make it a valuable asset, immune to the risks associated with government policies and central bank decisions.

Diversification of Risk

Gold offers diversification benefits, as it has a low correlation with traditional financial assets such as stocks and bonds. This means that when other markets are experiencing downturns, gold can provide stability and potentially generate positive returns.

The Negative Correlation of Gold as an Asset

Safe-Haven Status

When there is a loss of confidence in the financial markets, investors tend to flock towards gold as a store of value and a means to preserve wealth. This increased demand for gold during such periods tends to drive its price up, even as other assets decline.

Inflation Hedge

When inflation rises, the purchasing power of fiat currencies tends to decline, leading investors to seek assets that can maintain their value. Gold is often viewed as a reliable store of wealth in times of inflationary pressures, leading to increased demand and a potential rise in price.

Diversification Benefits

Gold's negative correlation with other assets makes it an effective diversification tool in a portfolio. As a non-correlated or negatively correlated asset, gold can help reduce overall portfolio volatility and risk. During periods of market stress or when other assets are performing poorly, the presence of gold can help cushion the impact and potentially generate positive returns.

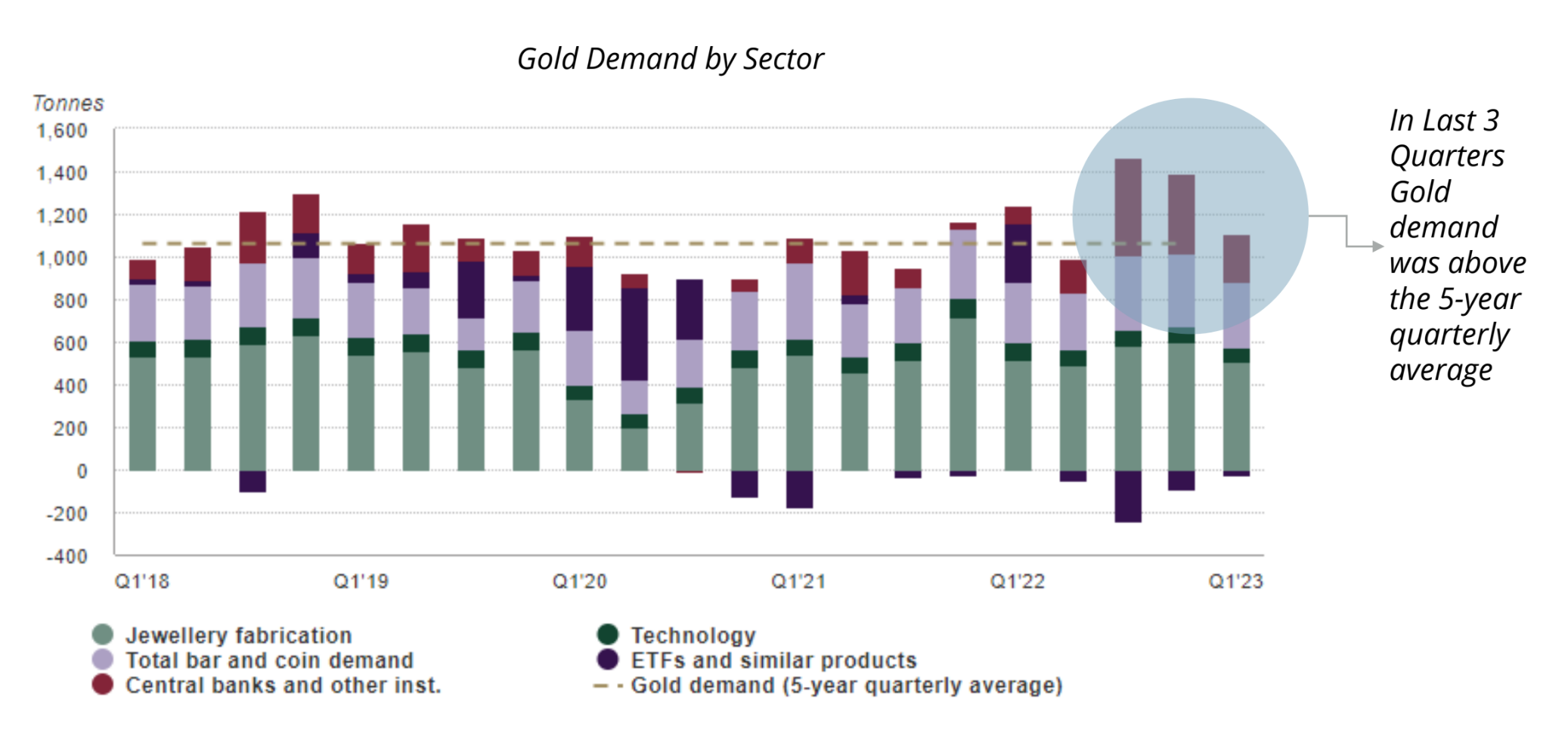

What drives the Gold demand?

Sources: Metals Focus, Refinitiv GFMS, World Gold Council; Disclaimer *Data as of 30 June 2023.

Jewellery & Retail Investment

Historically, jewellery has been the largest component of gold demand. Countries with a strong cultural affinity for gold jewellery, such as India and China, tend to be significant contributors to global demand. Retail investment, which includes gold bars and coins purchased by individuals, also plays a crucial role in overall gold demand.

Investment Demand

Gold is often sought after by investors as a safe-haven asset and a store of value. During times of economic uncertainty or market volatility, investor demand for gold tends to increase. Gold exchange-traded funds (ETFs) and similar investment vehicles play a role in driving demand in this category.

Central Bank Reserves

Central banks are significant buyers of gold and can influence demand. Many central banks see gold as a means to diversify their foreign reserves and reduce reliance on traditional currencies. The demand from central banks can vary depending on their policies, geopolitical developments, and efforts to hedge against economic risks.

Industrial & Technological Applications

Gold also finds use in various industrial and technological applications, such as electronics, dentistry, and aerospace. Demand from these sectors can fluctuate based on economic conditions, technological advancements, and changes in consumer preferences.

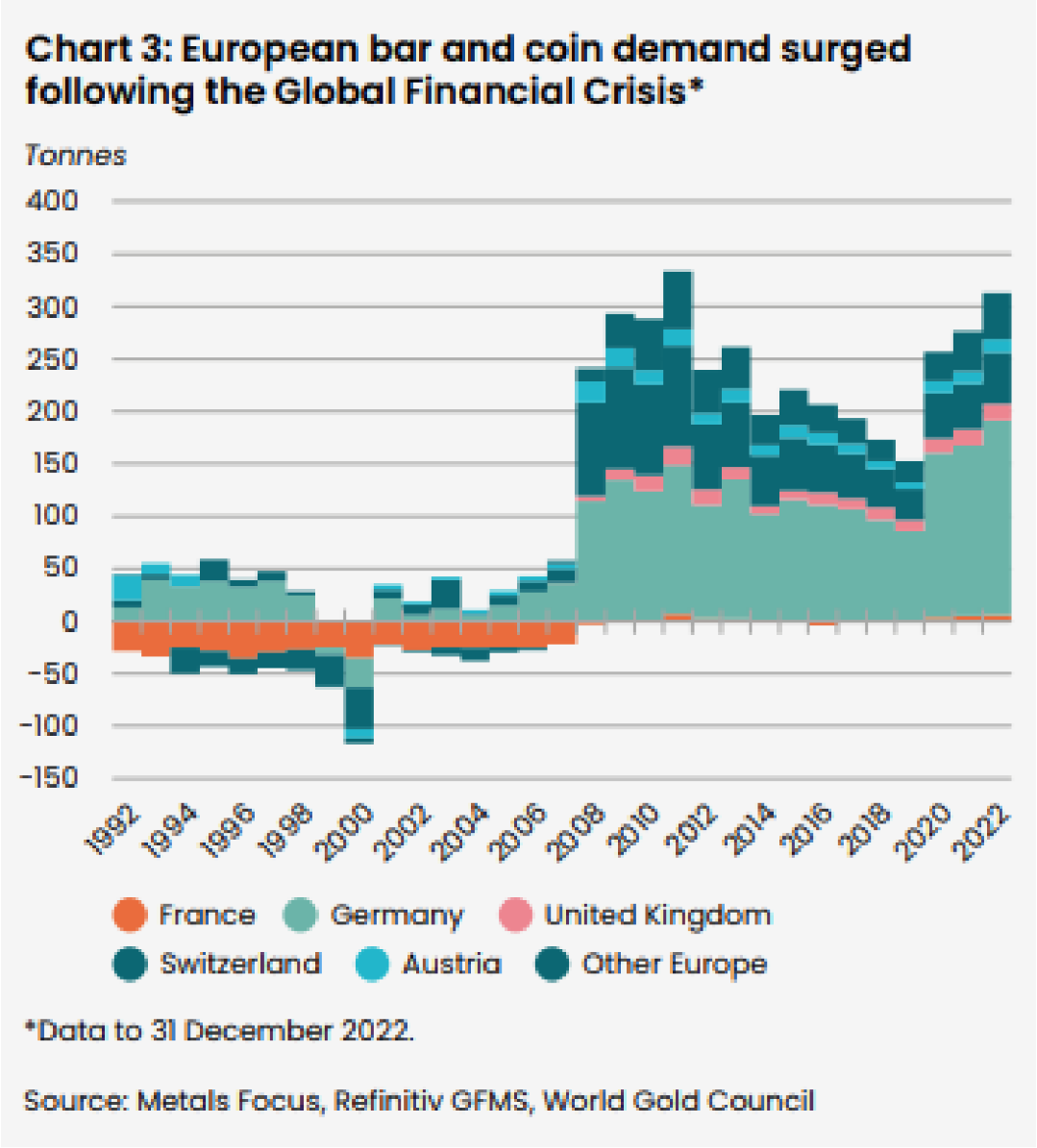

The demand for gold has been on the rise in recent years. Since the global financial crisis in 2008, global central banks demand for gold has hit all-time highs

20% increase in demand since 2020

Central Banks continue to have a positive view towards gold as a reserve asset in 2023

Gold Reserves

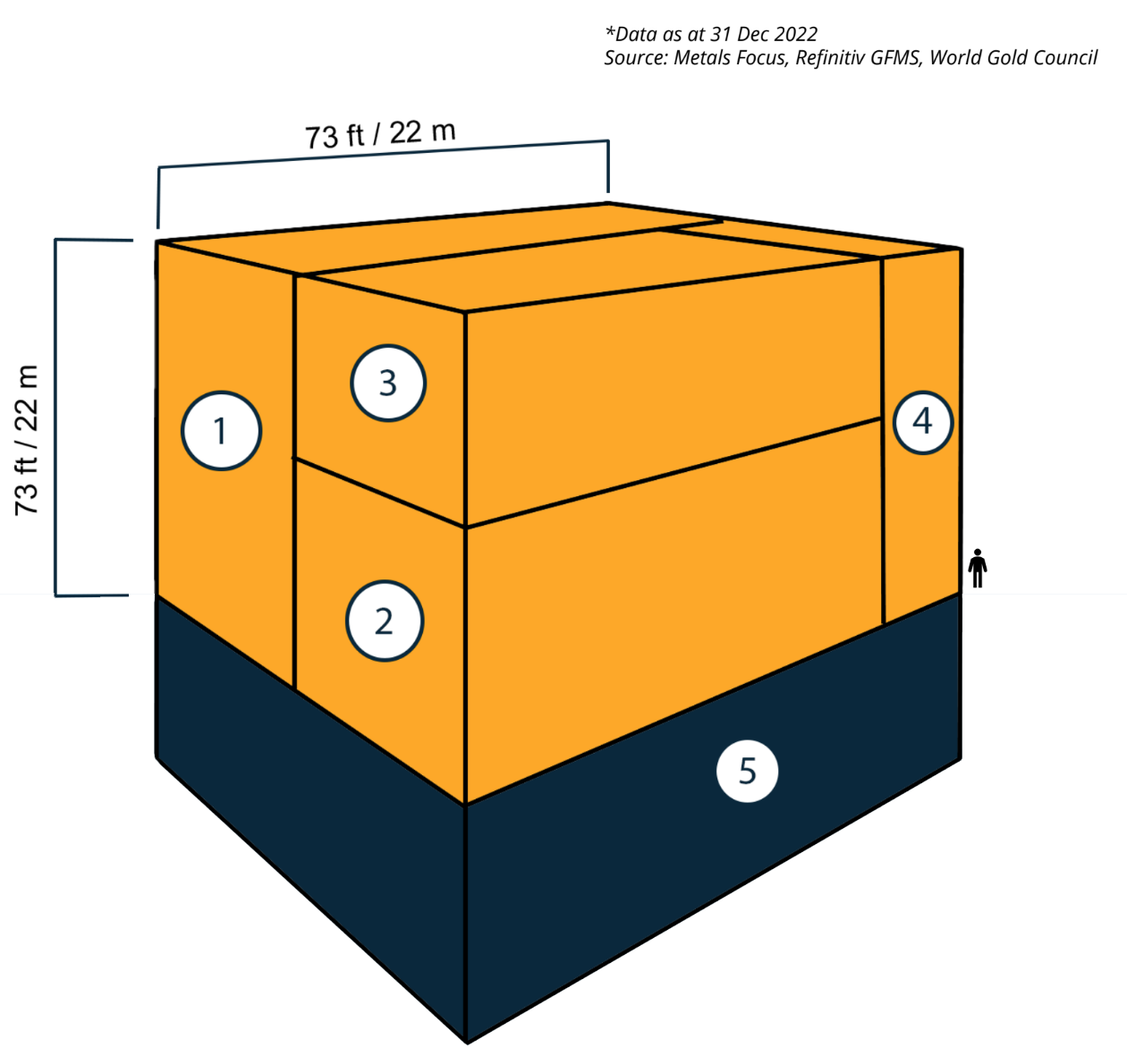

Best estimated availability suggests that around 208,874 tonnes of gold has been mined throughout history, of which approximately 2/3 has been mined since 1950. Almost all of this gold is still around in one form or another.

In every single ounce of this gold were placed next to each other, the resulting cube of pure gold would only measure around 22 meters on each side.

This breakdown of the above-ground stock of gold includes a time series of how it has evolved since 2010, and the latest year-end estimate of below-ground stocks.

Total above-ground stocks (end-2022): 208,874 tonnes

- Jewellery ≈ 95,547t, 46%

- Bars & coins (incl gold backed ETFs) ≈ 46,517t, 22%

- Central Banks ≈ 35,715t, 17%

- Other ≈ 31,096t, 15%

- Proven reserves ≈ 52,000t

*Data as at 31 Dec 2022. Source: Metals Focus, Refinitiv GFMS, World Gold Council

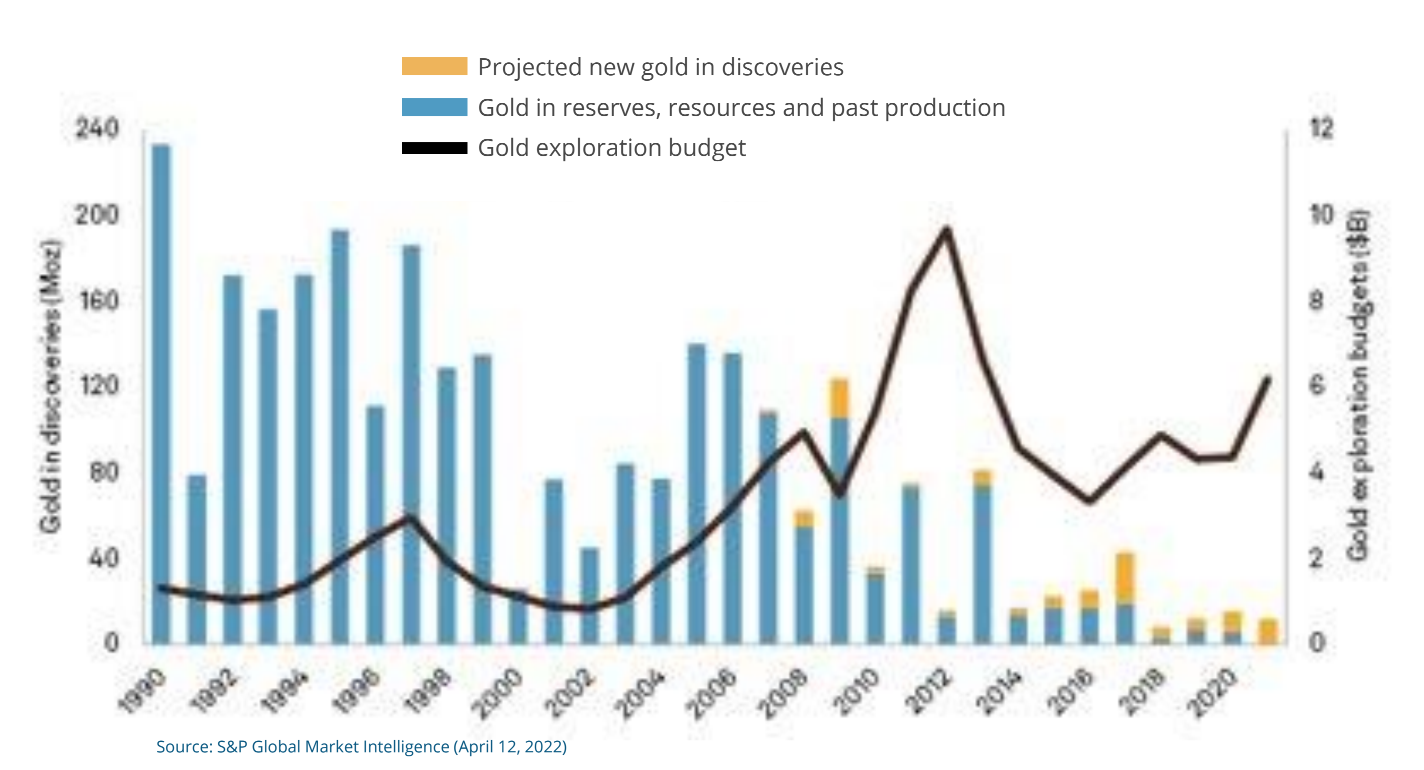

Gold discovery rates

Gold discovery rates have continued to decline, and unless discovery rates begin an upswing in the near future, there could be a lack of quality assets available for development in the longer term.

Source: S&P Global Market Intelligence (April 12, 2022)

According to S&P Global Market Intelligence, spending on finding new gold ounces remains at historically high levels, with the US$54.3 billion allocated to gold exploration over the past decade almost 60% higher than the US$32.2 billion spent over the preceding 18-year period.

However, the increase in dollars spent has not yet resulted in more new discoveries or discovered ounces compared with the previous period: Only 215.5 million ounces of gold has been defined in 41 discoveries over the most recent 10 years, compared with 1,726 million ounces in 222 discoveries in the preceding 18 years.

Projects with confirmed mineral resources and viable economics will be in demand in the coming years.

Next entry: The Role of Nuclear Energy in the Clean Energy transition

Previous entry: Nuclear Energy Renaissance?